Southern Africa—Provision of SME Banking Advisory Services to BancABC

Client: International Finance Corporation

Duration: 2011-2014

Region: Sub-Saharan Africa

Country: Regional

Solutions: Economic Growth

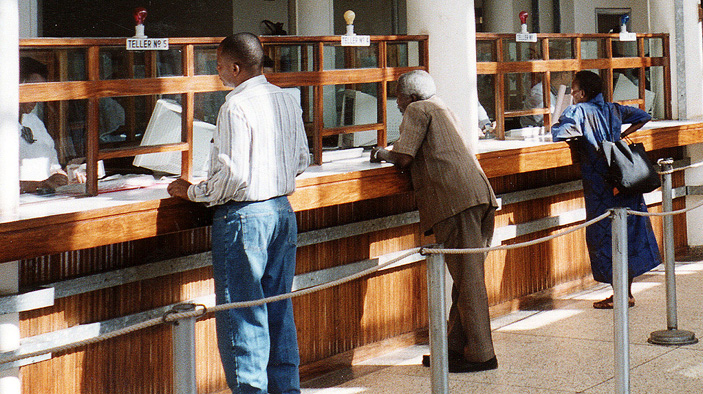

BancABC is a pan-African financial services group that operates in five countries: Botswana, Mozambique, Tanzania, Zambia, and Zimbabwe. The bank is developing a new business line focused on retail banking and lending to micro, small, and medium-sized enterprises (MSMEs).

ABC Bank obtained a $13 million loan from the International Finance Corporation (IFC) to strengthen the capital base of its Zambia, Mozambique, and Botswana operations. This gave the bank the capacity to expand into the micro and small business market segments. DAI helped BancABC build efficient and profitable operations that increased financial intermediation. This helped diversify BancABC’s portfolio with a new viable business line as well as support MSMEs to realize their full potential and make a larger contribution to each country’s gross domestic product.

Select Results

- Helped ABC Bank tailor its product portfolio to better serve entrepreneurs and small businesses.

- Assisted the bank to refine its operational policies and risk and credit policies and procedures.

- Developed training modules for eventual handover to the bank’s training department on areas such as training of trainers, on-the-job training, and classroom training for bank product, risk, and credit staff.

RELATED CONTENT:

Regional—AL-INVEST Next Programme Management Unit and EU-LAC Trade and Investment

The AL-INVEST Next Programme and its EU-LAC Trade and Investment Component promote a more dynamic and sustainable economic relationship between the EU and the countries of Latin America and the Caribbean.

Read More